Commodities onchain: gold and beyond

The last months in crypto have been dominated by one key narrative: stablecoin adoption. Circle IPOed, Stripe is building its own dedicated stablecoin chain, Plasma launched, dozens of new stablecoins went live. In general the eyes of the space are highly absorbed by the stablecoin narrative.

But, outside the mainstream perimeter, another story is quietly unfolding: commodities onchain.

The goal of this post is to analyse the current state of tokenised commodities, mainly focusing on gold, and to map out a few interesting platforms that could emerge as the future venues for onchain commodities tokenization and trading.

Market landscape

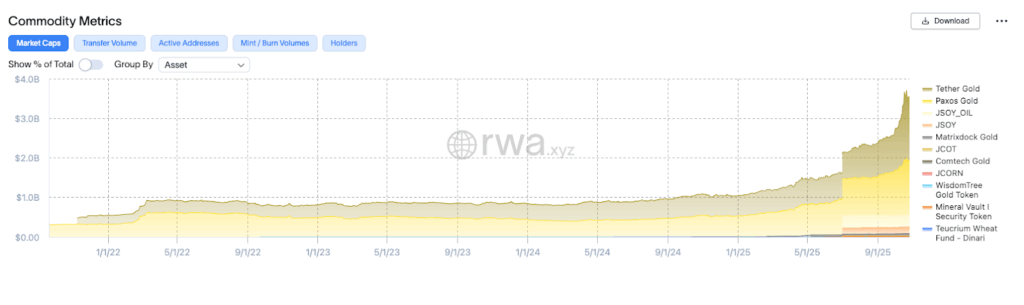

As of today, the total value of onchain commodities stands at around $3.5 billion, distributed across roughly 160,000 wallet holders, of which about 10% were active last month.

The vast majority of this value comes from gold tokens (~$3 billion), followed by agri-tokens (soy and soy oil, ~ $500 million), and then a long tail of smaller assets — mineral rights, silver, platinum, diamonds, and even uranium.

This represents less than 2% of the current stablecoin market, but almost a 4× increase since early 2025, when tokenised commodities totalled just over $1 billion. Some of that growth comes from gold’s 50% YTD price rise, but the broader trend is clear: investors are increasingly willing to own and manage commodities — especially gold — directly onchain.

The case of Gold

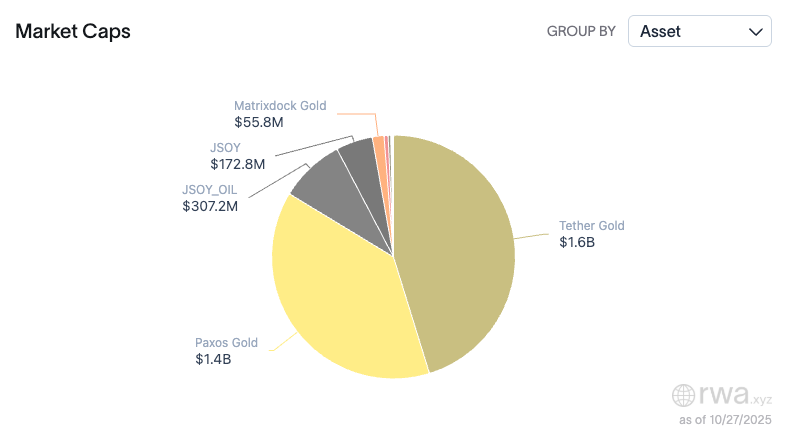

As the safe-haven asset by definition, gold has seen a remarkable appreciation in these turbulent times. Its growth onchain has been led by two major actors: Tether and Paxos.

Tether XAUT and Paxos PAXG now hold approximately 45% and 38% of the total onchain commodities market share respectively, and together account for almost $3 billion in total value locked (TVL).

Product type and jurisdiction

Their product design is conceptually similar: each token represents a title-bearing digital claim on physical gold. However, the legal structure and jurisdiction differ substantially.

PAXG is issued by Paxos Trust Company, a New York–chartered limited-purpose trust regulated by the New York State Department of Financial Services (NYDFS). Each token legally represents beneficial ownership of one fine troy ounce of an allocated LBMA (London Bullion Market Association) Good Delivery bar.

XAUT, by contrast, is issued by TG Commodities, S.A. de C.V., a company incorporated in El Salvador and affiliated with Tether Holdings Ltd. Similarly to PAXG, each XAUT represents ownership of one fine troy ounce of gold held in Swiss vaults.

Custody and inventory

Both tokens are fully backed by physical gold, not by ETFs or synthetic derivatives.

Paxos holds its allocated bars in LBMA-accredited vaults in London, with Brink’s cited as a key custodian. The gold is segregated from Paxos’s corporate assets, meaning token-holders’ metal remains bankruptcy-remote.

Tether’s XAUT reserves are stored in Swiss vaults controlled by a Swiss entity which is a related party to Tether Gold, but the exact custodian is not publicly disclosed in its legal filings.

Reserves attestations

Paxos publishes monthly attestation reports confirming that each PAXG token is backed one-to-one by allocated gold, verified by KPMG.

Tether began publishing quarterly attestations in 2025, verified by BDO, confirming that XAUT reserves match the number of tokens outstanding to within a negligible margin.

Issuance, Transfers and secondary market

Both tokens are ERC-20 compliant and freely transferable on the Ethereum network (with XAUT also available on TRON). However, primary issuance is permissioned: only verified users can mint (or redeem) PAXG or XAUT through the issuer, subject to KYC and other checks. Secondary transfers appear open-market and unrestricted.

Importantly, both have built-in freeze/asset-protection logic: for example, the PAXG contract grants the issuer the right to freeze and even wipe balances in certain cases. The XAUT Terms of Service similarly give the issuer the right to freeze tokens belonging to users, suspend redemptions or transfers, in line with compliance provisions.

They both enjoy active secondary markets on exchanges and DEXs, though liquidity remains modest compared with fiat-backed stablecoins.

Redemption

KYC-verified users can redeem PAXG for physical gold in two forms:

as unallocated Loco London balances (effectively swapping an on-chain claim on Paxos for an off-chain claim on a London bullion bank’s pooled reserves)

as allocated Good Delivery bars, though only for redemptions above roughly 430 oz, delivered to a UK vault.

Tether Gold follows a similar model: redemptions are restricted to KYCed holders with at least 430 XAUT, with settlement in the form of physical bars delivered to Swiss vaults.

Ecosystem

This is arguably the weakest aspect. Despite their scale, both tokens have limited onchain utility. I didn’t find any major lending market where PAXG can currently be used as collateral — only a governance proposal on Aave has been submitted but not implemented yet (Aave proposal). XAUT, on the other hand, is technically supported as collateral on Aave v3, but adoption remains minimal, with low borrowing volumes and limited integrations (Aave market overview).

Both tokens can still be traded or staked in liquidity pools, but few DeFi applications actively build around them. For now, on-chain gold remains more of a digitally portable store of value than an actively composable financial primitive.

Platforms

Beyond gold, some other commodities are being tokenised, but in my opinion the most interesting development lies in commodities-focused infrastructure — dedicated platforms and chains designed specifically for issuing and managing real-world assets on-chain.

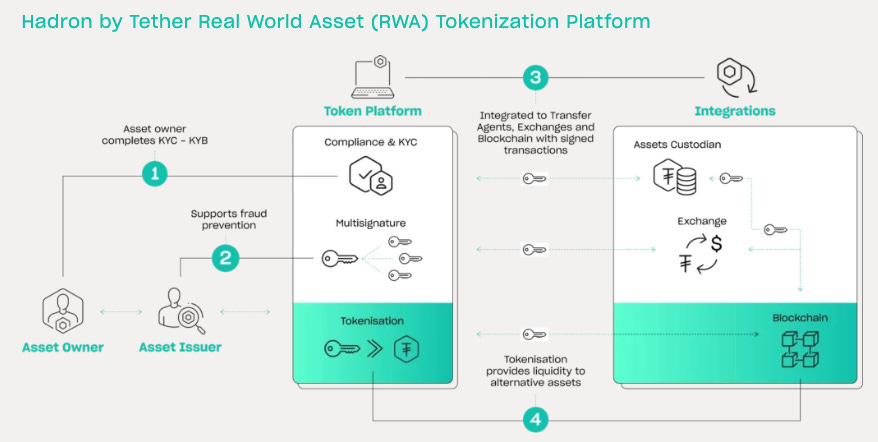

The most compelling one by far is Hadron, developed by Tether. Hadron is a tokenization platform that combines traditional asset-management standards with blockchain interoperability. Key features include:

A built-in KYC/KYB/KYT module for on-chain identity verification and transaction screening.

Integrated fraud-prevention and AML controls, developed in partnership with Chainalysis.

Connectivity with transfer agents, exchanges, asset custodians, and other blockchains, allowing seamless settlement and cross-chain issuance.

Support for Bitcoin’s Liquid sidechain, enabling secure issuance and redemption of tokenised commodities while leveraging Bitcoin’s settlement assurance.

What, in my opinion, truly distinguishes Hadron from other tokenization platforms is its native integration with asset custodians. The platform is being designed so that custody, reserve verification, and redemption flows are embedded directly into the protocol layer — ensuring that tokenised commodities can be transparently audited, independently verified, and redeemed through recognized custodial partners. This custodial anchoring makes Hadron uniquely suited to the commodities use case, where physical custody, reserves transparency, and redeemability are as important as on-chain liquidity.

Another notable project is Watr, a dedicated chain built on Avalanche aiming to become the primary venue for on-chain commodities issuance and trading. Its architecture includes:

WatrMrks, immutable asset tags for end-to-end traceability;

WatrIDs, a decentralized identity layer for producers and traders;

NeoReserves, liquidity pools designed for commodity-finance contracts; and

VentureStream, a launchpad for commodity-tech solutions.

The project is not yet live, but it benefits from an experienced team and growing institutional attention toward tokenised commodities.

Conclusions

As I wrote in my previous series on tokenisation, every on-chain asset ultimately hinges on one thing: the nature and enforceability of the legal claim it represents. In commodities, this point becomes existential.

Self-custody is not an option for commodities. Physical goods demand professional safekeeping, which in turn demands trust. What matters most is not only who holds the metal, but under what legal structure, in which jurisdiction, and with what redemption logic.

A token is only as strong as the right it confers — and in the case of gold or oil or copper, that right must survive scrutiny in a court of law.

If these foundations are solid — if custody, reserves transparency, and redemption are hard-wired into the protocol rather than appended as promises — the market could expand dramatically. Sound infrastructure would make tokenised commodities not just speculative instruments, but trusted stores of value and reliable collateral for a broad DeFi economy.

Once those custody rails are in place, my impression is that safe-haven assets like gold will migrate on-chain almost by gravitational pull. They will sit comfortably alongside native digital assets as the next generation of base collateral — tangible, scarce, and yield-generating through composability.

And beyond institutional products, there is still space for a retail gold stablecoin: one that allows ordinary users to hold and redeem tokenised gold with the same ease as they swap stablecoins today. It would merge the timeless appeal of gold with the accessibility of crypto — a quiet but powerful act of financial inclusion.

Resources

https://chain.link/article/tokenized-commodities-how-they-work

PAXG

https://www.justoken.com/

https://uranium.io/

https://www.uraniumdigital.com/